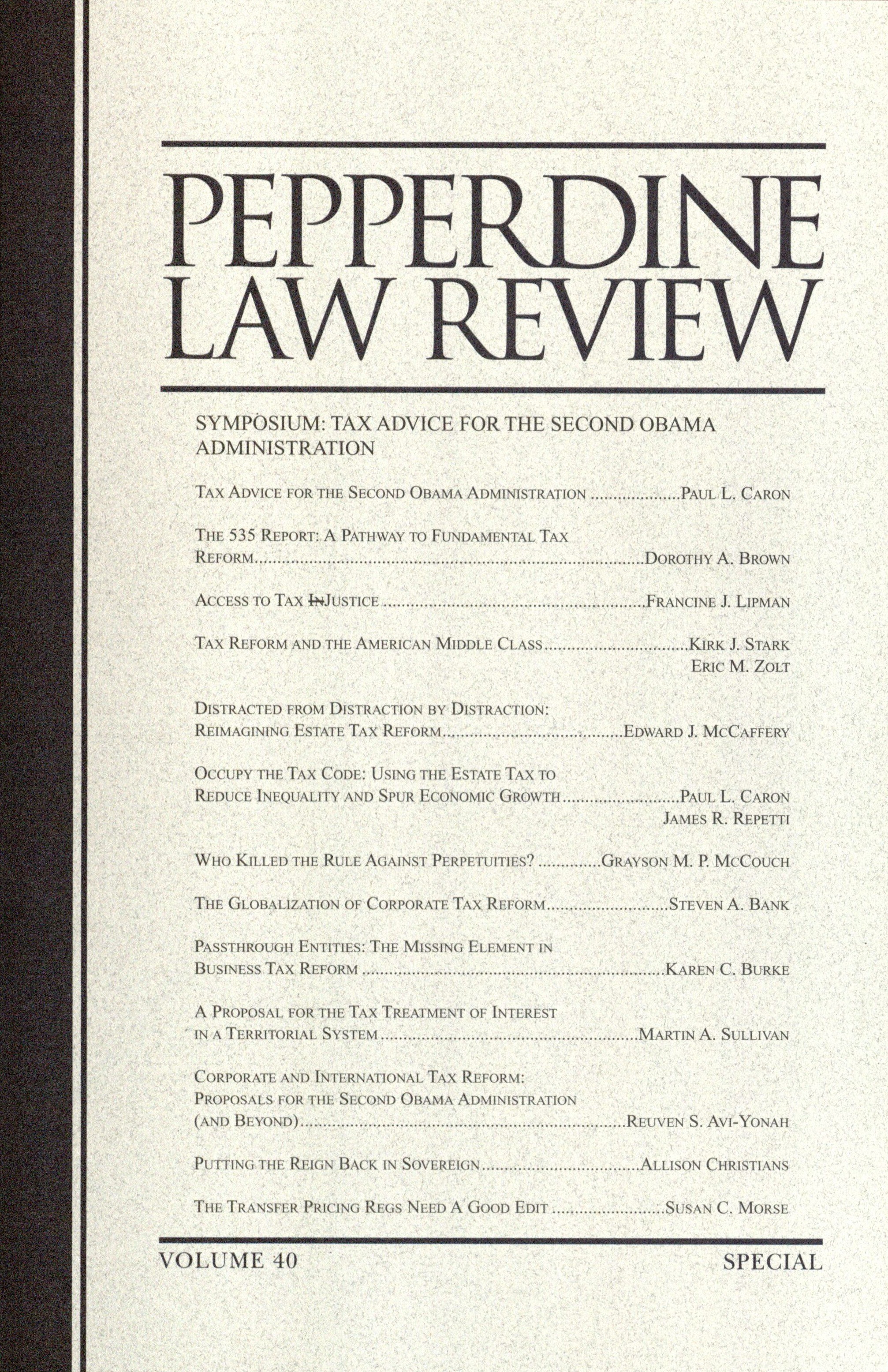

Volume 40, Issue 5 (2013) Symposium: Tax Advice for the Second Obama Administration

This issue was published as a special issue in Volume 40, after issue 4. As published, It does not have a numerical designation.Articles

Tax Advice for the Second Obama Administration

Paul L. Caron

The 535 Report: A Pathway to Fundamental Tax Reform

Dorothy A. Brown

Access to Tax InJustice

Francine J. Lipman

Tax Reform and the American Middle Class

Kirk J. Stark and Eric M. Zolt

Distracted from Distraction by Distraction: Reimagining Estate Tax Reform

Edward J. McCaffery

Occupy the Tax Code: Using the Estate Tax to Reduce Inequality and Spur Economic Growth

Paul L. Caron and James R. Repetti

Who Killed the Rule Against Perpetuities?

Grayson M. P. McCouch

The Globalization of Corporate Tax Reform

Steven A. Bank

A Proposal for the Tax Treatment of Interest in a Territorial System

Martin A. Sullivan

Corporate and International Tax Reform: Proposals for the Second Obama Administration (and Beyond)

Reuven S. Avi-Yonah

Putting the Reign Back in Sovereign

Allison Christians

The Transfer Pricing Regs Need a Good Edit

Susan C. Morse

Editors

- Editor-in-Chief

- Margot Parmenter

- Managing Editor

- Lukian Kobzeff

- Production Editor

- Mark Reinhardt

- Symposium Editor

- Michael Wood